Contents:

On this https://forexaggregator.com/, the Bullish Kicker candlestick pattern is more dramatic. Neither of the candles involved has wicks, so the gap between them is clear. The gap is also wide, increasing the pattern’s significance and reliability. Following the Bullish Kicker pattern, a vast gap appears, followed by a pair of white candles. Confident investors will be rewarded for trusting this Bullish Kicker.

There must be a downside gap where the wicks of the second and third bars don’t touch. The second and third candles must have progressively smaller bodies with longer upper wicks. If a stock is $100 and we place our stop loss at $90, we’ll be risking $10. Those of you who are more advanced or quantitative can argue with this measure of risk — rightfully so, but for now, it’ll do. An edge occurs when your expected payout is greater than the money you put in. The bearish version is exactly the same in the opposite direction.

This shape in its purest form is a solid block with no wicks, but once again, Marubozos are very rare in the forex arena. When you see them in forex, they may have a ‘shaved head’ on the top or bottom (Marubozo roughly translates to ‘shaved head’), and a wick on either side. To make the most out of your technical analysis, you must combine several reversal indicators’ results. According to statistics, a bullish kicker acts as a bullish reversal 53 percent of the time.

Unique Three Rivers

Three outside up/down are patterns of three candlesticks on indicator charts that often signal a reversal in trend. All ranks are out of 103 candlestick patterns with the top performer ranking 1. “Best” means the highest rated of the four combinations of bull/bear market, up/down breakouts. The Bullish Kicking Pattern is highly reliable, but still, a confirmation of the reversal on the third day should be sought.

Signs of Seller Exhaustion Left Stocks Primed for a Big Bounce – Bloomberg

Signs of Seller Exhaustion Left Stocks Primed for a Big Bounce.

Posted: Fri, 06 Jan 2023 08:00:00 GMT [source]

The quickest way to improve your competency as a forex trader is to invest a few hours on candlestick pattern recognition, especially when it pertains to forex charts. It can be both an offensive and defensive weapon in your trading arsenal. After developing a familiarity of the basic shapes, concentrate on reversal and continuation formations that often appear in a series of candles.

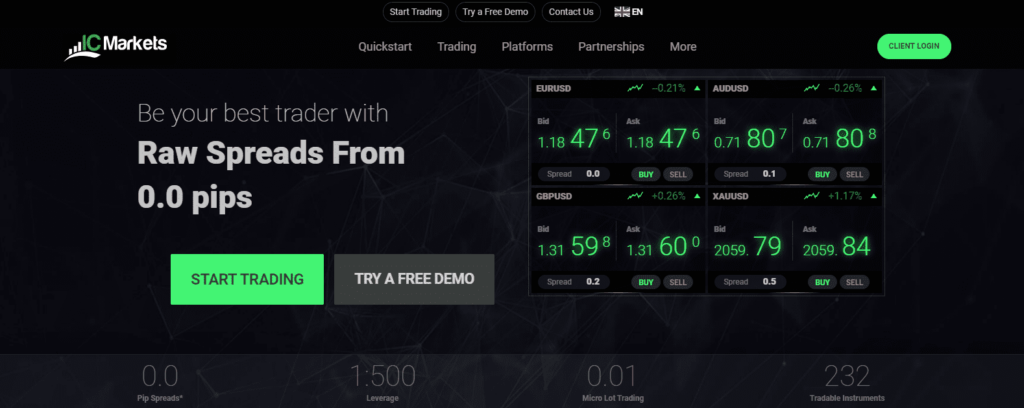

The https://trading-market.org/ moves up and to the right after pattern identification, leading to a profitable bullish reversal trade. We’re going to keep it simple and not talk about support and resistance areas, volume, or any other technical analysis tools used in conjunction with candlestick patterns. The goal is to isolate the best candlestick patterns and teach you how to trade them according to the data. There are two types of kicker candlestick patterns – bullish and bearish.

Morning Star

The companies and services listed on this website are not to be considered a recommendation and it is the reader’s responsibility to evaluate any product, service, or company. Patternsmart is not responsible for the accuracy or content of any product, service or company linked to on this website. If you want to find out the performance of “Bullish Kicking ” in real market, not theory, this is a must have reference. The list of symbols included on the page is updated every 10 minutes throughout the trading day.

Dogecoin [DOGE] buyers can leverage this pattern’s break to their benefit – AMBCrypto News

Dogecoin buyers can leverage this pattern’s break to their benefit.

Posted: Thu, 17 Nov 2022 08:00:00 GMT [source]

Candlestick bullish patterns forex recognition can become a formidable tool for discovering high-probability trading setups. Their interpretation can yield a wealth of information about market psychology and where prices might be headed. For the bullish kicking pattern, the first red Marubozu signifies a slowing of momentum in a downtrend and a bit of uncertainty. Buyers and sellers slow down their pace in order for this unique shape to eventuate.

Statistics to prove if the Kicking pattern really works

A long bearish candlestick is followed by another bearish candlestick. However, both of them have the same close that suggests a short term support is forming and may cause a reversal on the following candlestick. This is a reversal signal that occurs in the beginning of a trend, during a trend and at the end of a trend. It is bullish kicking when a bearish Marubozu is followed by a bullish Marubozu .

It is a certainty that professional and veteran traders are fully aware of their import and that they act swiftly when the high-probability patterns reveal themselves. It does not take an inordinate amount of time to learn about candlesticks. The bullish kicking candle acts as a bullish reversal of the existing price trend 53% of the time. That is almost random, so do not try to guess the breakout direction from this candle pattern. That means the candle was rare enough that I only included partial statistics in my Encyclopedia of Candlestick Charts book. The overall performance 10 days after the breakout is 96, probably due to the dearth of samples.

The constant tug of war among these players is what forms candlesticks patterns. Candlestick charting originated from a technique developed in Japan in the 1700s that tracked the price of rice. Candlesticks are a suitable technique for trading any liquid financial asset such as stocks,futures, and foreign exchange. Circled in red is a bullish kicking candlestick on the daily scale. This one appears in a brief downward retrace of the up trend.

The timestamp is only as accurate as the clock in the camera, and it may be completely wrong. Free members are limited to 5 downloads per day, while Barchart Premier Members may download up to 100 .csv files per day. Also unique to Barchart, Flipcharts allow you to scroll through all the symbols on the table in a chart view. While viewing Flipcharts, you can apply a custom chart template, further customizing the way you can analyze the symbols. Unique to Barchart.com, data tables contain an option that allows you to see more data for the symbol without leaving the page.

The bullish candle is completely engulfed by the body of the bearish candlestick. Crucially, the white candle’s bottom wick doesn’t extend into the red candle’s body. As you have learned, the signal heralds a bullish reversal, which occurs directly thereafter. Following the gap, there are several white candles and the price moves consistently upward.

Bullish High Wave

The bearish marubozu is a one-bar bearish reversal pattern that’s best traded using a bullish continuation strategy in all markets. The bearish abandoned baby candlestick pattern is a three-bar bearish reversal pattern that’s best traded as advertised. Crypto traders should avoid this pattern due to the lack of statistically significant trading setups. With a bullish kicking candlestick pattern the first day’s bearish candlestick is a sign that bears are completely in charge. However the large gap up the next day is a substantial change in market psychology. The bulls were able to eliminate all losses obtained by the bears the previous day plus add further gains with the gap up and long bullish candlestick.

- The gap between the two candles of the kicking pattern sets the significance of the signal.

- Many of your exhaustion gap trades will continue in the direction of the primary trend for some period of time.

- As you know, under certain circumstances, a Bearish pattern can also perform as a Bullish pattern, and a reversal pattern can be changed into a continuation pattern.

- Greater the length of the candle, greater is the strength of the bulls in the market.

What makes this reversal so potent is that an entire day of bearish shorts placed on day one is now losing money. When these shorts capitulate and are forced to buy back these shorts, even more buying pressure will be added to the market pushing prices up even further. The kicking candlestick pattern is a two-bar trading pattern that signals an upcoming reversal of the current trend in the market. The kicking candlestick pattern often appears after a surprise event or news announcement before or after market hours. The gap between the two candles of the kicking pattern sets the significance of the signal. The kicking pattern is one of the most popular trading patterns because it is among the strongest and most influential trading patterns that cannot be overlooked.

We analysed 4120 markets for the last 59 years and we found occurrences of the Kicking pattern. It means for every $100 you risk on a trade with the Kicking pattern you lose $11.7 on average. Wait for one or two more candles to validate the exit of the chartist figure from above or below. Technical analysis is full of many indicators that you need help finding your way around.

The ladder bottom is a rare five-bar bullish reversal pattern that’s best traded as intended in the stock market. Data-driven forex and crypto traders should pass on this rare pattern. The evening star is a three-bar bearish reversal pattern that’s best traded using volatility-capturing strategies across all markets. The bullish engulfing is a two-bar bullish reversal pattern that’s best traded using a bullish mean reversion strategy across all markets. The bearish tri-star is an extremely rare three-bar bearish reversal pattern that’s best traded as indented in all markets.

Investing and Trading involves significant financial risk and is not suitable for everyone. No communication from Rick Saddler, Doug Campbell or this website should be considered as financial or trading advice. It will draw real-time zones that show you where the price is likely to test in the future. A step by step guide to help beginner and profitable traders have a full overview of all the important skills (and what to learn next 😉) to reach profitable trading ASAP.

All you need to know is the OHLC values, which are the https://forexarena.net/hand for open, high, low, and close prices. Supply and demand move based on fundamentals and human emotion. Understanding how prices moved in the past gives traders an insight into how prices will likely move in the future. Candlestick charts are aptly named because when the price is grouped into periods, such as a day or an hour, it forms a candle shape, which we’ll see in a second. A Green candlestick followed by two red candlesticks like in the image. A Red candlestick followed by two green candlesticks like in the image.